Today, the markets can be accessed by anyone at any time. This ease of access makes people take investing lightly. The reality, however, is more complicated. The financial market should only be explored with appropriate financial literacy. Don’t know where to find financial literacy? Welcome to Prestigio Lumeze.

Prestigio Lumeze is a website that provides quick and easy access to financial education. We connect anyone with tutors so far as they are willing to learn. With these tutors, beginners and investors looking for a fresh start can understand the financial market to its core.

However, the best thing about this offer is that it is free for everyone. Prestigio Lumeze made it so that people can learn enough to make informed financial decisions. Sign up with Prestigio Lumeze for free to get started with suitable tutors.

Originally, Prestigio Lumeze was developed for beginners. We’ve realized the need for a solid foundation in understanding investing’s complexities. But given the alarming number of uninformed investors, we are open to experienced minds, too. With Prestigio Lumeze, beginners get to meet tutors who are ready to develop them from the ground up.

For years, the financial market has been excluded for a selected few. Technology changed this narrative, and Prestigio Lumeze is set to equip people to invest appropriately. How? By making investment education easily accessible.

In order to have this opportunity open for all, Prestigio Lumeze has created an avenue where anyone can connect with suitable tutors free of charge. Sign up on Prestigio Lumeze to begin.

We became aware of communication barriers in our attempt to democratize financial education. Our target audience is spread all across the world; what did we do?

Prestigio Lumeze is designed to be multilingual. This way, anyone can use our website and connect with tutors in their language. Connect with tutors for free via Prestigio Lumeze.

Prestigio Lumeze defines it as the innate ability to use financial resources responsibly. It’s necessary to recognize and utilize the knowledge and skills required for informed decisions. Prestigio Lumeze is committed to creating a financially literate world.

It covers budgeting, saving and finance management, insurance, investing, and strategic analysis. Financial literates see and use the bigger picture in shaping their choices. To access tutors and begin learning, sign up for free with Prestigio Lumeze.

The essence of knowledge and skills for investors could never be overstated much. With it, they can understand market trends, manage capital resources, implement strategies to mitigate risk, and seek out financial goals.

Finance is said to be as old as time. The oldest form can be traced to Ancient Mesopotamia (800-950 BCE). At the time, merchants traveled miles through challenges to exchange goods and precious items. The popular system of finance then was the trade and barter system.

The book-entry system was established by the Royal Medici family in the 15th century. This set the grounds for the foundation of our modern financial market. By 1602, the Dutch East India Company had released shares of stock on the Amsterdam Stock Exchange. This became recognized as the first-ever stock exchange in the world.

Thanks to technological advancements, the 19th century brought rapid economic development. This growth led to the ‘roaring 1920s’, a time of abundance. The financial markets.were teeming.

Then, it crashed. Consequently, the 20th century led to more initiatives like hedge funds, mutual funds, and ETFs. The late 1990s saw even more advancements as the internet came into light.

The advent of www (World Wide Web) changed the world of finance forever. No more were investors top wealthy individuals as everyone had access to the internet. Then, on January 3, 2009, bitcoin was launched. This became the first of many digital currencies introduced. Sign up on Prestigio Lumeze to learn about cryptocurrencies.

Every investor must know about these two economic setbacks. The Great Depression of 1929 was due to an oversaturation in the stock market. Then, in 2008, negligence and over-exposure in real estate brought about The Great Recession. Both posed severe damage to the global economy.

What Was The Significance Of The 1929 Crash?

Unemployment rates rose. Food lines became quite common. The market didn’t begin to recover until WW2 broke out in Europe.

What Followed The 2008 Recession?

Many lost their homes. The government printed money to bail out the banks, leading to a rise in inflation.

What Possible Threat Of Economic Downturn Looms?

The US debt is one source of concern. 80% of existing dollars were printed between 2020 and 2021.

Interestingly, most people don’t understand the significance of all these. This is why Prestigio Lumeze advocates for financial literacy. Want to learn more? Sign up on Prestigio Lumeze.

It all boils down to this. No one should dive into the financial market carelessly. Consequently, Prestigio Lumeze enables people to learn directly from tutors. These would provide the required training. Sign up for free with Prestigio Lumeze to get started.

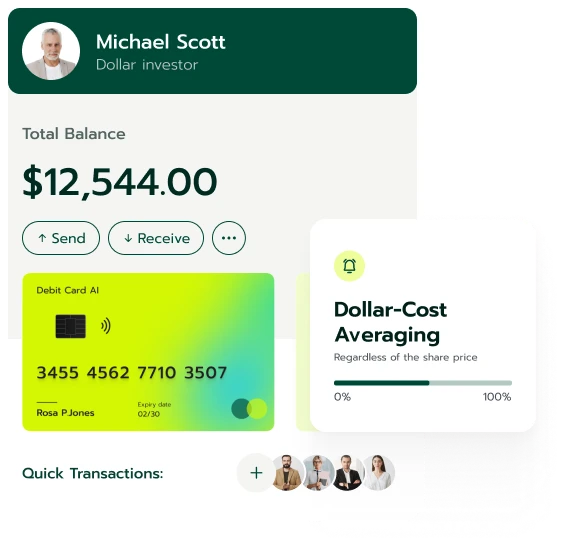

For us at Prestigio Lumeze, we define investing as allocating capital into securities or assets in the financial market. This is done to pursue certain financial goals and objectives. Generally, investors are long-term players, and they need knowledge and certain skills.

Given the uncertainty of the financial market, investors usually attempt to diversify their portfolios. Don't know what this means? It is an effort to invest in numerous assets with varying risk levels and potential. This way, an investor may not lose all their investment at once.

Patience, consistency, and discipline are traits to have as an investor. In a world where anything can happen, decisions should be informed and objective. Thanks to Prestigio Lumeze, people can learn more about appropriate investing. Sign up to find tutors.

These are financial institutions, corporations, or private individuals that allocate capital to a financial asset. This asset can vary from business startups to cryptocurrency. An investor typically commits to two or more assets to diversify their source of income.

To make informed decisions, an investor must be given financial education. This is where Prestigio Lumeze comes in. Learning with tutors empowers investors to understand the financial market at large. Sign up with Prestigio Lumeze to get started with this education.

These are large corporations like a bank system. Institutional investors usually help customers and clients manage and invest their capital. Typically, they invest in high-risk assets such as large shares of shock, mutual, or hedge funds. They have opportunities private investors cannot access. Sign up with Prestigio Lumeze to know more about them.

These types are affluent individuals who provide capital resources for small businesses or enterprises. The risk of investing in such assets is high, but they invest in these to get capital ownership in the business. Sign up with Prestigio Lumeze to learn about these investors.

For these, they participate long-term in the financial market. Passive investors typically invest in index funds. Learn more via Prestigio Lumeze.

These are investors that are concurrent with the financial market. Active investors study trends, patterns, and market forecasts. Unlike passive investors, they prefer to invest in high-risk assets. Interested in becoming an active investor? Learn from suitable tutors via Prestigio Lumeze.

In investing, there are no guarantees. Investment outcomes are often well beyond the investor’s influence. There’s always a chance of taking a hit on any asset.

Risk and rewards are tied to one another. There’s no living without dying. However, Prestigio Lumeze believes education can inform investors on managing risks. Find financial education via Prestigio Lumeze.

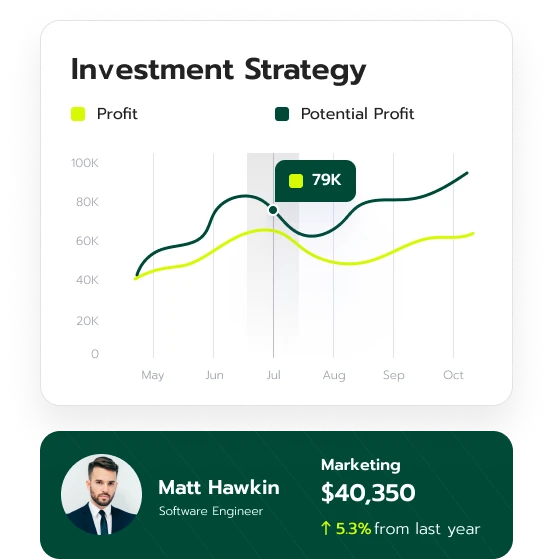

They are systems of guidelines curated by investors to seek financial goals and objectives. Investment strategies depend on several factors, such as the initial capital, the level of risk, and the goal the investor intends to achieve.

Investment strategies can either be aggressive or conservative, depending on the level of risk. They may help investors stay focused, read market forecasts, identify potential pitfalls, and implement measures to mitigate risks.

Common types of investment strategies include portfolio diversification, value or growth investing, using financial derivatives, and fundamental or technical analysis as well. Want to have an in-depth understanding of investment strategies? Why not sign up for Prestigio Lumeze for free?

When it comes to investing, loss is something an investor cannot avoid. But at Prestigio Lumeze, we believe the risks responsible for these losses should not be feared but instead understood. When investors understand them, they will be able to recognize them and come up with measures to manage them. Sign up with Prestigio Lumeze to connect with tutors .

This is also called market risk. It can lead to a blanket loss of investment in the financial market. They are caused by factors such as political overturn or policies. Sign up on Prestigio Lumeze to learn how to recognize them.

This type makes it challenging for an investor to sell assets. Sign up for free on Prestigio Lumeze to learn more.

This type is one of the mistakes investors make when starting out. They focus all their capital on one asset and become more vulnerable to a total loss. To learn more about how to diversify, sign up on Prestigio Lumeze.

These factors cause the cost of goods and services to rise. Sign up on Prestigio Lumeze to understand inflation and its relation with recession.

This usually occurs with fixed-income assets. They are factors that make it difficult for creditors to meet up with the deadlines of their loans. Sign up with Prestigio Lumeze to learn more about the factors responsible for this.

These factors develop when new regulations or policies are implemented. This sometimes affects the cost of commodities and securities in that region. Sign up with Prestigio Lumeze to learn more.

Everyone in modern society needs to understand the financial scene. As markets are now at people’s fingertips, so should an insightful education. Prestigio Lumeze is intentional about helping anyone get started. As soon as they sign up, we make sure they are matched with tutors. Through us, anyone would be equipped with the knowledge and skills required for informed financial decisions.

| 🤖 Registration Cost | Free of Charge |

| 💰 Financial Charges | No Additional Charges |

| 📋 Registration | Quick and Straightforward Process |

| 📊 Education Opportunities | Crypto, Mutual Funds, Forex, Stocks |

| 🌎 Supported Countries | Available Worldwide, Excluding the USA |